Digitalization of Banking Services — A Driver of Turkmenistan’s Economic Development

Digitalization holds a key place in Turkmenistan’s economic strategy. Under the leadership of the esteemed President, large-scale digital reforms are being implemented in the country’s banking sector. Services such as “Internet Banking,” “Mobile Banking,” “Digital Loans,” and “VISA Virtual” not only create convenience for customers but also enhance efficiency across all sectors of the economy.

New Services and Customer Opportunities

Among the latest features currently offered by banks are:

VISA Virtual – a convenient digital card for online payments

Galkynysh Payment System – expanded opportunities for transactions in foreign currencies

Online Reception – access to banking services anytime, anywhere

Digital Loans and Digital Payments – systems that allow users to take loans and make payments easily via mobile devices

These services not only improve service quality but also save customers time, reduce paperwork, and offer greater convenience.

Statistics: Clear Indicators of Growth

In the first four months of 2025, 6.7 thousand clients connected to the “Digital Payment” service

During the same period, more than 33.8 million manats in loans were issued through the “Digital Loan” system

The total volume of cashless payments reached 6,773.9 million manats, a 35% increase compared to the same period last year

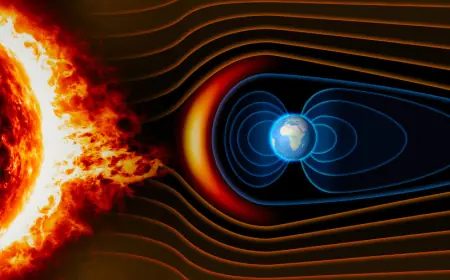

The Future of Digital Services: Broader and More Secure Systems

Turkmen banks are not only launching new services but also working to enhance information security, protect against cyber threats, and introduce new server infrastructure. These efforts ensure the resilience of digital systems and build customer trust.